Overview

- T+1 is real and will be a regulatory requirement.

- There is a lot to do, especially around introducing automation to increase STP, reduce errors and deliver post trade processes to T+1 timescales (i.e. same day).

- You have to start NOW to be ready by 11th October 2027. The consequences of late engagement are probable increases in operational costs. The US experience appears to have resulted in a 16-18% increase in staff costs due to a lack of automation and process redesign.

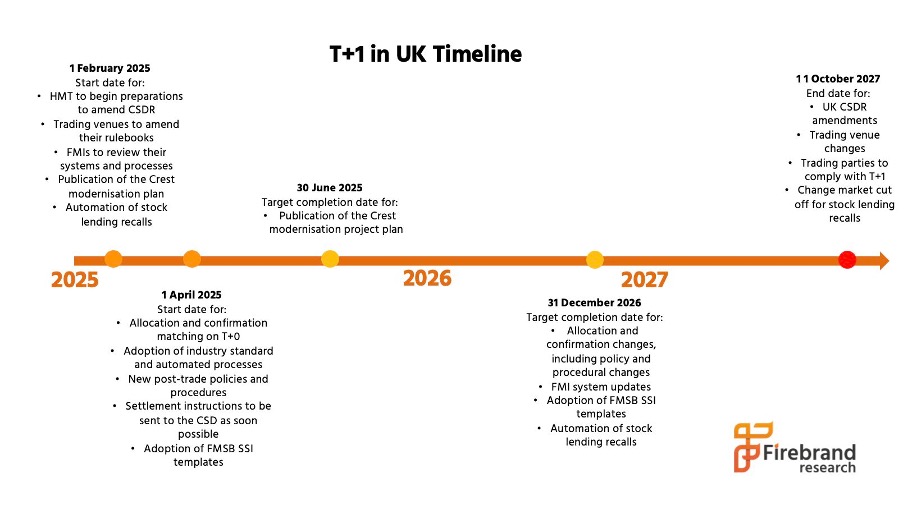

The Accelerated Settlement Taskforce (AST) Technical Group has published its final Implementation Plan for the UK’s first day of trading for T+1 settlement on 11th October 2027.

This has the information that firms need to plan and prepare, including:

- Geographic and instrument scope, including the impact if Europe doesn’t move at the same time

- Regulatory expectations

- Operating model requirements (with actions categorised as Critical, Highly Recommended, and Environment)

- Expected behaviours

The AST has recognised that firms cannot achieve T+1 goals in isolation and are dependent on their counterparties providing accurate and timely information and rapid exception resolution. The T+1 Code of Conduct (UK-TCC) covers all regulated firms and includes sections on expected behaviours (1.6). These include planning that shows what they are doing to prepare for T+1, including timelines, budget and testing, with Internal Audit or Compliance oversight.

Other points to call out are:

- The T+1 operating model needs high levels of automation to support faster allocation, confirmation, and settlement instruction processing with much earlier cut-offs. This includes static data.

- Exception processing needs to support this: minimal manual intervention, rapid identification of differences, appropriately skilled and authorised people to investigate and resolve. Counterparty and 3rd party agreements need appropriate SLA timings and deadlines.

- Offshore clients, counterparties, and processing will bring in additional complexities with the need to support time zone differences.

The starting point is to review and assess internal processes against the T+1 Code of Conduct (UK-TCC), establish the project plan, and secure funding. The expectation is that this starts now, with changes complete, ready for testing, by January 2027.

The review and assessment needs to cover at least the Critical and Highly Recommended actions. Items to note are:

- Critical actions are those deemed critical to the success of the move to T+1, to be implemented as soon as practicable

- Allocation and confirmation processing completed electronically as soon as practicable and no later than 23.59 UK time on T0 (SETT 01)

- Settlement instructions into the CSD as soon as practicable and no later than 05.59 UK time on T+1. Intermediary cut-offs will be earlier (SETT 02)

- Policies and procedures to support this (allocations, confirmations, settlement instructions) (SETT 03)

- SSIs shared in line with the Financial Markets Standard Board’s (FMSB) Core Principles and templates (STAT 01)

- Automated stock loan recalls (SFT 01) and adherence to recall cut-off times and return deadlines (SFT 02)

- These are supported by Highly recommended actions to maximise the operational benefits of T+1. These include market level settlement processing efficiency monitoring, the need to review relevant bilateral and third-party agreements, auto partial/splitting and auto shaping, PSET/PSAF communication and usage, and static data, including ensuring that reference data functions are prepared for the implementation of T+1. Corporate action and FX processing will also be impacted.

- It is anticipated that mutual funds will move to T+2 settlement at the same time.

- Exceptions need to be reviewed and analysed. How many root causes are there that need to be fixed?

- The business case should also look at the impact on the front office and the need to be ready to minimise potential additional costs – e.g. agent fees, fines, lines of credit.

Does the project need to start now?

The project has ‘Settlement’ in the title and the go-live date is Q4 2027. Does it really need to start now? It’s easy to make statements like:

- This isn’t a ‘throw people at it late on’ programme; or

- Failure to put in place the building blocks and plans to support effective automation and exception management will result in poor customer service, reputational damage, and significant direct and indirect cost.

Aside from the UK regulatory expectation, the best reason for starting now is the US experience, where a lack of focus on automation appears to have resulted in a 16-18% increase in staff costs due to a lack of automation and process redesign.

Feedback from firms that have already started shows both the potential scale of the challenge and the opportunity to build a new operating model that addresses long-standing inefficiencies. For example:

- Data is going to be key. We know we have to sort this out and have kicked this off already

- The eventual target model needs to support same day settlement including digital assets. T+1 is an interim deliverable in a multi-year transformation programme

- There are a lot of inefficient, manual processes in our firm. Addressing these as part of our T+1 operating model solution not only delivers automation benefits but also removes a lot of noise

- The costs and risks of upgrading our legacy system may be too high and we should be looking at replacement options

- The costs of upgrading our infrastructure may be too high and we should be looking at outsourcing options

- There may be a business opportunity here to win new clients that will need to consider outsourcing options

It’s also worth noting that the marginal cost of dealing with firms that can’t support automated same-day processing will be significantly higher than today.

TORI are actively working with firms to help them prepare for these changes. We have a deep understanding of market participants’ businesses, including their products and services, client types, front to back flows, infrastructure, 3rd party providers, and regulatory obligations. We have a long track record of providing innovative and effective solutions.